As you all know, the CARES Act (PRF) reporting guidelines are out and the portal is open. We have been working in the background on what is needed and what will be required and a dedicated team to better serve all of you with the reporting.

The first round of reporting through the portal is due no later than September 30, 2021 for funds received prior to June 30, 2020. We can assist with the information and guidance for the PRF reporting requirements and we will be reaching out to many of you who have already signed an engagement for us to do so over the course of the next week. It is important to strategically report on any PRF funds you received and to keep track of the important deadlines. For those that we have not signed an engagement with already, please let us know if you will need our assistance by reaching out to the following:

Traudi Bandura – traudib@dhcg.com

Shonna Cannaday – shonnac@dhcg.com

Crystal Roach – crystalr@dhcg.com

Natalie Oud – natalieo@durbinco.com

The reporting portal is designed to be completed by the hospital personnel and requires specific hospital login data and two-factor authentication from the hospital representative for completion. For this reason, please be sure to register, if you have not already at the following link: Home (hrsa.gov)

In regards to QIPP and the nursing facilities, it is our understanding that the location of ownership (as in EIN number affiliation) at the time of PRF fund receipt, is the entity responsible for the reporting. In other words, if the nursing facility fell under your EIN at the time of receipt for the associated PRF funds, then your facility will be responsible for the PRF reporting for that entity. We also understand that the portal is set up to only allow for consolidated reporting. It is our suggestion to separate the reporting by entity as you compile information, but for HHS reporting through the PRF federal payment portal, this will need to be consolidated.

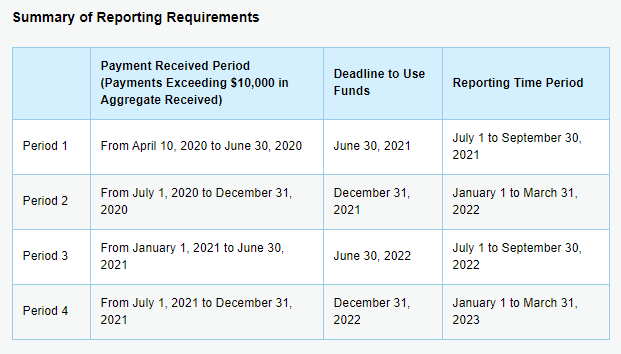

Following is a summary of the reporting deadlines:

If you received one or more payments exceeding $10,000 during a period, you are required to report in each applicable period as outlined above. We know there are three options on reporting and we encourage you to reach out to discuss the best method for your facility. Options are: the difference between actual patient care revenues (calendar year 2019 compared to calendar year 2020); the difference between budgeted (must be approved by board prior to March 27, 2020) and actual patient care revenues (calendar year 2020); and any reasonable method of estimating revenues. It is important to note that all three will be subject to audit in some form.

We hope that this helps get you started and want you to know that we are available and ready to assist you.